Blog & News

Solar system subsidy: Your path to affordable solar energy

As the world moves toward greener and more sustainable energy solutions, solar energy is becoming an increasingly attractive option for homeowners and businesses alike. But did you know you can make your solar investment even more affordable with subsidies? That's right! Solar system subsidy could help you save a significant amount of money while reducing your carbon footprint. In this article, we'll explore why investing in solar energy is a smart move in 2024 and break down the various subsidies available to help you make the switch to solar energy easier.

Why should you invest in solar energy?

Before we answer the question, Is there a subsidy for solar systems?, we should first know why you should choose solar energy.

- Unlimited resources: Solar energy is inexhaustible, meaning you can use it without depleting the Earth's resources.

- Environmental impacts: The use of solar energy significantly reduces carbon dioxide emissions, thus contributing to combating climate change and protecting the environment.

- Energy independence: Solar energy allows you to generate your own electricity, reducing your dependence on traditional utilities and protecting you from fluctuating energy prices.

- Long-term savings: Although there are initial costs, investing in solar panels can significantly reduce your electricity bill over time and provide a return on investment as solar technology becomes more affordable.

- Government incentives: Many regions offer subsidies and tax incentives for investing in solar energy, making it more financially accessible and advantageous.

- Energy storage options: You can store excess solar energy for use on cloudy days or at night, ensuring a constant power supply when you need it.

- Potential source of income: If your system produces more energy than you use, you may have the opportunity to sell the surplus back to the grid, creating an additional source of income.

What connection for solar systems will there be in 2024?

In 2024, governments and organizations will offer a wide range of financial incentives to encourage the use of solar energy. These subsidies can take the form of rebates, tax credits, or direct financial support. Let's examine them in detail, starting with government subsidies and moving on to local options.

State subsidies for solar systems

In 2024, various Subsidies for solar systems offered to promote the use of renewable energy. Here's a look at some of the most important government subsidies available:

Feed-in tariff

The well-known Solar system feed-in tariff compensates you for the electricity generated by your solar system when you feed it back into the public grid.

Remuneration rates: Currently, the tariff is 8.2 cents per kilowatt hour (kWh) for systems up to 10 kilowatt peak (kWp). For larger systems (10 kWp and above), the tariff is 7.8 cents per kWh.

Upcoming adjustments under the “Solar Package I”

The Federal Ministry for Economic Affairs and Climate Protection is planning significant changes that are expected to come into force on January 1, 2024; the actual effective date is scheduled for May.

Remuneration rates:

- For self-supply systems up to 10 kWp: 8.2 cents per kWh.

- For larger self-supply systems (from 10 kWp): 7.1 cents per kWh.

- For full feed-in systems, the tariff rates increase: 13.0 cents per kWh for systems up to 10 kWp and 10.9 cents per kWh for systems over 10 kWp.

Rural connections

Many German states offer various financial incentives to promote the adoption of renewable energy solutions. These programs are designed to make it easier for homeowners and businesses to invest in clean energy technologies. The following information is current as of December 2023.

- KfW Renewable Energies – Standard (Program 270)

o Type of funding: low-interest loans.

o Eligible measures: Construction, expansion and acquisition of photovoltaic (PV) systems and energy storage systems.

o Coverage: Up to 100% of the investment costs.

- Schleswig-Holstein Climate Protection for Citizens

o Eligible measures: Balcony solar systems (250–600 watts) and green electricity-based battery storage systems.

o Funding amount: One-off payment of €200 for balcony systems and €750 for battery storage.

- North Rhine-Westphalia Progres.nrw

o Eligible measures: Installation of new energy storage systems with new PV systems.

o Status: To be redesigned for 2024.

Connections at the municipal level

In addition to federal and state subsidy programs, many municipalities in Germany promote solar energy with their own subsidy programs. To obtain the most accurate information, it is recommended to consult local authorities or energy agencies, as specific offers may vary. Here is an overview of important government subsidies in various cities:

- Bonn: Solar Bonn

- Financial support: €100 per kilowatt peak (kWp) for photovoltaic systems, provided the entire usable roof area is used.

- Darmstadt: Photovoltaic funding program

- Financial support: €200 per kWp of installed capacity, but a maximum of €6,000.

- Düsseldorf: Climate-friendly living and working

- Financial support: Supports PV systems up to 30 kWp and plug-in solar systems and covers up to 20% of the investment costs for battery storage.

- Erlangen: Energy saving and use of renewable energies

- Financial support:

- 150 € per kWp for systems between 1 and 30 kWp (max. 4,500 €).

- €75 per kWp for systems between 31 and 100 kWp (max. €5,250).

- 150 € per kWh for battery storage (max. 1,050 €).

- Freiburg: Funding program for climate-friendly housing

- Financial support: Subsidies for solar storage in combination with PV systems, provided that at least 15% of the house's electricity needs are covered.

- Mannheim: Solar Bonus

- Financial support: Basic subsidy of €100 per kWp (max. €1,000), with premium subsidy of €160 per kWp (max. €2,400) for systems with at least 15 kWp roof area.

- Munich: Energy Saving Funding Program

- Financial support: Supports PV systems up to 30 kWp and new battery storage systems.

- Münster: Climate-friendly living

- Financial support: €300 per kWp for PV systems on facades, apartment buildings and green roofs.

- Stuttgart: Stuttgart Solar Offensive

- Financial support: Supports PV systems, plug-in solar systems, battery storage and wallboxes for electric vehicles.

- Wiesbaden: Solar power subsidy program

- Financial support: Includes the funding of PV systems with and without battery storage as well as necessary meter box conversions.

Tax incentives

Starting in 2024, solar plant operators will be able to take advantage of several favorable tax incentives. These changes aim to reduce the financial burden associated with solar installations and encourage wider use of renewable energy. Here is a summary of the main available tax incentives:

- Zero percent VAT rate: A new zero percent VAT rate applies to the purchase of photovoltaic systems, allowing buyers to purchase solar systems without additional VAT.

- Income tax exemption for smaller investments: Operators of photovoltaic systems with a capacity of up to 30 kWp benefit from an income tax exemption. This applies to both new and existing systems and offers significant savings for operators of smaller systems.

- Extended tax return support: Tax assistance associations can now prepare income tax returns for solar energy operators. This service was not available before 2023 and makes it easier for individuals to manage their solar energy-related tax obligations.

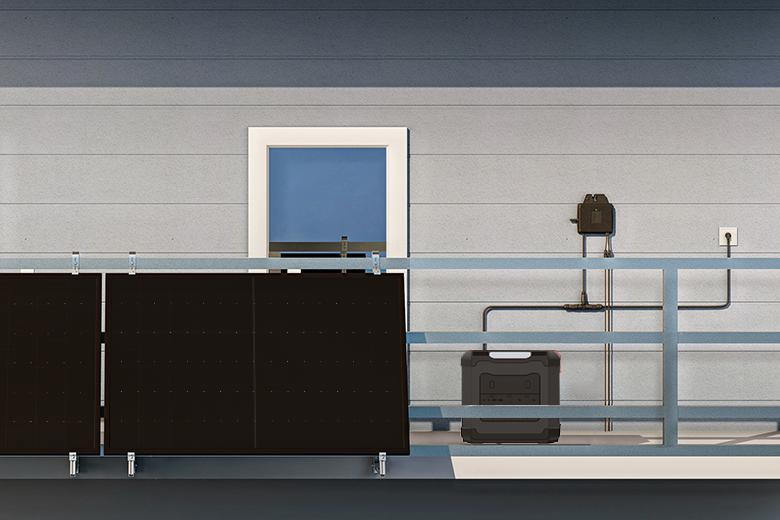

Bonus: Anker Mini Solar System for Garden & Garden House

If you're looking to harness solar energy in your garden or shed, the Anker Mini Solar Panel for Garden & Shed is an excellent option. Not only does it contribute to a more sustainable lifestyle, but it also provides control over energy consumption and paves the way to energy independence. Here are some compelling features that make this mini solar system a smart choice:

- DIY installation: The system is designed for easy installation, so you can set it up yourself without the need for professional help.

- Long service life and warranty: Thanks to the robust construction and extended warranty, you can rely on the system's efficient energy production for years.

- Optimal use of sunlight: In well-lit gardens, the Anker solar system can produce sufficient energy every day, making it a powerful solution despite its compact size.

- Individual energy supply: With this mini solar system, you can operate garden lighting, irrigation systems, and garden sheds independently of each other. You enjoy flexibility and reduced dependence on the power grid.

- Flexible adaptation: The system can be easily adjusted to achieve optimal positioning for capturing sunlight and thus ensure maximum efficiency.

Conclusion

In 2024, the investment in a Solar system subsidy A great way to save money while helping the planet. From federal tax credits and state rebates to local incentives and tax exemptions, numerous financial tools are available to make solar power more affordable than ever. By taking advantage of available subsidies, you can significantly reduce the upfront costs of installation and reap the benefits of clean, sustainable energy.

FAQs

How much funding do I get for a solar system?

Subsidies for solar installations vary, but you can typically benefit from the federal solar energy subsidy program and state incentives. Homeowners can receive low-interest KfW loans and grants that cover significant installation costs. Additionally, local municipalities offer various rebates, and EEG payments allow you to profitably sell excess solar energy back to the grid, increasing overall savings.

Will solar systems also be exempt from VAT in 2024?

Yes, in 2024, solar installations will benefit from a zero percent VAT rate, effectively exempting them from VAT. This change makes it easier and more affordable for buyers to invest in solar photovoltaic systems and encourages the adoption of renewable energy solutions across the country.

What does the government pay for solar systems?

The government provides €100 per kilowatt-peak of installed capacity for solar systems, with a maximum subsidy of €1,500 for systems up to 15 kWp. In addition, systems on green roofs, historic buildings, or as building-integrated PV façades receive an additional flat rate of €200.

What feed-in tariff will I receive in 2024?

The feed-in tariff for private photovoltaic (PV) systems in Germany with a capacity of up to 10 kWp will be 8.03 cents per kilowatt hour starting in August 2024. For solar systems with a capacity between 10 and 40 kWp, the tariff will be 6.95 cents per kilowatt hour.