Blog & News

Can I operate a PV system without registration?

In Germany, PV systems are generally required to be registered. You can only operate a PV system without registration in exceptional cases. Learn more here about the cases where this bureaucratic hassle is waived.

First things first

PV system without registration?

You may operate a PV system without registration if it is not connected to the electricity grid.

What penalties are threatened?

If you operate a PV system without registration, you face a fine of up to €50,000.

Operation without feed-in meter

If you operate a PV system without a feed-in meter, the electricity meter will run backwards. This is considered a criminal offense.

Where do I register photovoltaics?

PV systems connected to the grid must be registered with the Federal Network Agency, the grid operator and the tax office.

Can I operate a PV system in Germany without registration?

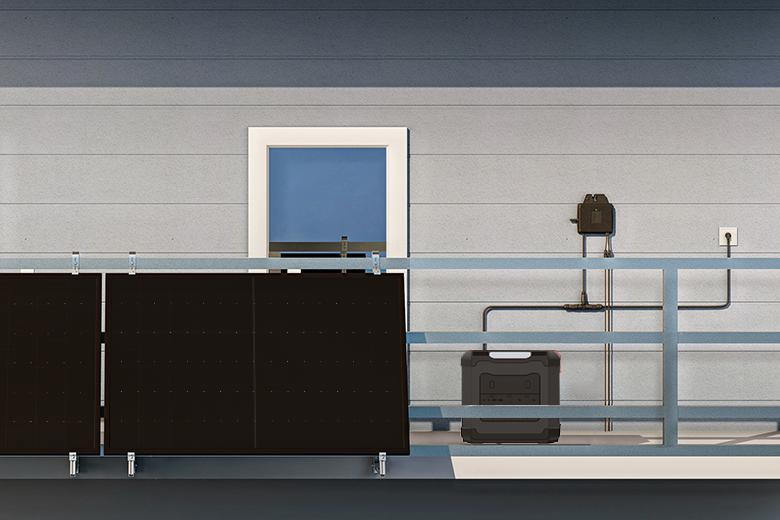

In Germany, a PV system can be operated without registration if it is not connected to the general grid. This is the case with so-called off-grid PV systems. If a grid connection is available, registration is mandatory for both the system operator and the solar system.

The registration of the PV system is independent of whether you feed the surplus self-generated solar power into the grid or not. The decisive factor is the Mains connection.

If you operate a grid-connected PV system without registration, the electricity meter will run backwards when feeding in electricity. In Germany, running backwards is considered a criminal offense punishable by a prison sentence of two to five years or a fine.

Therefore, you must register the PV system with the grid operator before you start the installation and feed-in meter The PV system must also be reported to the Federal Network Agency and the tax office upon completion, otherwise a penalty may be imposed.

Compare photovoltaic offers now and save 30%!

Take 60 seconds and fill out a short form. We will connect you with up to five verified specialist companies in your region. The comparison is free and non-binding.

What penalty is there for operating a PV system without registration?

You must register the PV system within one month of commissioning. Delayed registration will result in a reduction in the feed-in tariff. Failure to register the PV system at all is considered an administrative offense. In such cases, you will be subject to a fine of up to €50,000 under Section 95 of the Energy Industry Act (EnWG).

Where else do I have to register a PV system?

After commissioning the photovoltaic system, you must register it with the Federal Network Agency. The agency will register the operator and the system in the market master data register. If the PV system is connected to the public electricity grid, you must also register it with the grid operator and the tax office.

Federal Network Agency

The Registration with the Federal Network Agency consists of entering the essential data of the PV system into the Market Master Data Register (MaStR). Registration is carried out by the operator or an authorized representative. According to the Renewable Energy Sources Act (EEG), every system connected to the public grid must be registered.

Network operator

To install a PV system, you must register it with the local grid operator. The operator will conduct a grid compatibility assessment and check your electricity meter within eight weeks. You may only install the photovoltaic system after receiving approval. It is recommended that you submit your application at least eight weeks before the start of installation. For PV systems under 10 kWp, registration is generally not a problem.

In order for the grid operator to pay you the feed-in tariff, you must register your PV system with the grid operator within one month of commissioning. This requires confirmation from the Federal Network Agency and the commissioning report.

tax office

Register your solar power system with the tax office within the first month of commissioning. This is required by law, as operating a PV feed-in system makes you a business for tax purposes. Feeding electricity into the grid and receiving compensation for it are considered a sale for tax purposes.

The simplified tax exemption, which exempts PV systems with less than 30 kWp from income tax, has been in effect since January 1, 2023. This applies retroactively to existing systems as of January 1, 2022. You still have to register the system with the tax office, but your profits from the feed-in tariff will no longer be taxed.

Trade office

PV systems with a capacity of less than 30 kWp for private use are exempt from trade tax under the simplified regulation. However, if your solar system is installed on a commercial building, it must be registered with the trade office, regardless of its size and yield.